AOPA Flight Training Loan for student pilots - How and why

Learning how to fly an airplane is a big dream for many students. That is why the AOPA Flight Training Loan is a great choice for student pilots.

Flight training in the United States can be very expensive. Many people cannot pay for it all at once. It helps you pay for flight school now and gives you time to pay the money back later.

Get ready to understand what this

- AOPA Flight Training Loan is

- what you need to apply

- how to get a Social Security Number

- how to build a credit score

and why using a loan can be a smart and safe way to pay for flight training.

What Is the AOPA flight training Loan?

The Aircraft Owners and Pilots Association (AOPA) offers this loan to help people who want to become pilots. It can pay for flight lessons, ground school, exams, or other flight training costs.

The word “flexible” means that you can choose how you want to pay it back. Some students choose smaller payments while they are in school and bigger payments after they finish training. This makes it easier to focus on flying without worrying too much about money right away.

Who Can Apply for the Loan?

To apply, you must be at least 18 years old, have a way to prove income or savings, and have a Social Security Number (SSN).

You also need to be in the United States legally, such as being a U.S. citizen or an international student with the right visa.

For international students, the SSN is very important. It is a number given by the U.S. government that shows you are allowed to work in the country. The SSN also helps the bank check your credit history before giving you a loan.

How a Student Pilot Can

Get a Social Security Number

If you are an international student and do not have a Social Security Number, don’t worry — you can still get one if you have an on-campus job at your university.

Most schools allow students with an F-1 visa to work part-time on campus (usually up to 20 hours per week). When you get an on-campus job, your school will help you apply for an SSN through the Social Security Administration.

But what if you have an M-1 visa? Students with an M-1 visa are not allowed to work on campus.

That being said, you can talk to your university’s international student office and ask about changing your visa from M-1 to F-1. The school must approve this change. Once you have an F-1 visa and an on-campus job, you can apply for an SSN and use it when applying for the AOPA flight training loan.

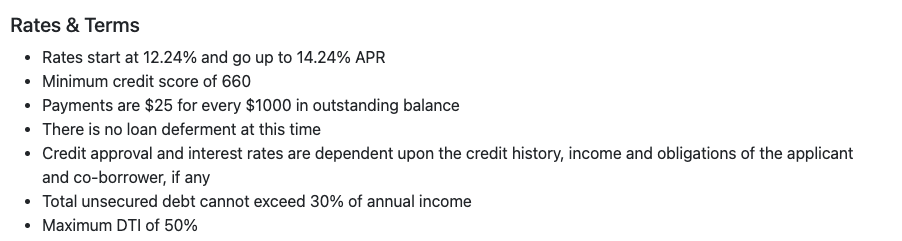

You can see the rates below. To finish all the way to a commercial pilot license you would need around $80,000 USD.

Showing Proof of Income or Assets

When you apply for the AOPA Flexible Aviation Loan, the lender needs to know that you can pay the money back. That means you must show proof of income (such as pay from a job) or proof of assets (such as money in your bank account).

If you don’t have enough income or savings, you can still apply by asking someone to apply with you.

This is called a joint loan or co-signed loan.

The co-signer can be a family member, relative, or friend who has a job and a good credit history. This person promises to help pay the loan if you cannot.

Having a co-signer can make it easier to get approved.

How to Build a Credit

Score in the United States

Your credit score is a number that shows how well you handle money and pay bills. Lenders use it to decide if they should give you a loan.

If you are a new student in the U.S., you might not have a credit score yet.

That’s okay — you can start building one.

Here are some easy ways to build your credit score:

-

Get a starter credit card.

Some companies, like Discover, make it easier for students and new residents to get their first credit card. -

Use the card carefully.

You don’t need to spend much. Even if you just buy a small item once a month and pay it back on time, it helps build your credit. -

Keep the balance low.

Try not to use too much of your credit limit. Using less than 30% is best. -

Always pay on time.

Paying your bills before the due date is one of the most important parts of a good credit score.

Even just having a credit card and paying it off every month helps you build trust with lenders. Over time, your credit score will grow, and it will be easier to get loans with lower interest rates.

Why a Student Pilot Should

Consider Getting a Loan

Go through private pilot flight training and become a pilot ASAP.

Some people want to pay for flight training with their own money instead of getting a loan. But for many students, using the AOPA flight training loan is actually a better idea.

Here are some reasons why:

-

You can start training sooner.

You don’t have to wait until you save enough money. The loan helps you begin flying right away. -

You can focus on your training.

With a loan, you don’t need to worry about running out of money halfway through your lessons. You can pay for all your classes, books, and flight hours with less stress. -

It’s a good investment.

Being a pilot usually pays well. After you finish training and start working, you can earn enough money to pay back your loan. That’s why AOPA and its lenders are confident in giving these loans — they know pilots have strong career opportunities. -

Peace of mind.

Having a steady plan to pay for your education helps you feel calm and focused. You can enjoy flying without worrying about every dollar.

If you do make it through training you will be able to pay this back as an airline pilot today.

Getting the AOPA Flexible

Aviation Loan is a great step

Getting the AOPA Flexible Aviation Loan is a great step toward becoming a pilot. You will need a Social Security Number, which you can get by having an on-campus job if you have an F-1 visa. If you have an M-1 visa, talk to your school about switching to an F-1 so that you can work and apply for the loan.

You will also need to show proof of income or assets, or you can apply with a co-signer if you don’t have enough yourself. Building your credit score is also important, and it can start with something simple like getting a Discover credit card and paying your bills on time.

By using a loan, you can begin flight training sooner, stay focused on your dream, and enjoy peace of mind knowing that pilots usually earn enough to repay their loans.

The sky is waiting for you — and with the AOPA Flexible Aviation Loan, you can take off toward your pilot career with confidence and a solid financial plan.

Maximize your time in flight training

Want more information on why now is the time to start private pilot flight training? Then click on the link.

Want to make sure you are getting the most out of flight training? Then check out how to get ready for your accelerated flight training for your private pilot.

If you need someone to help you through the process then comment below or sign up for your free one-on-one consultation.

I look forward to hearing from you!